how to transfer money from india to usa without tax

Call us on 15108257563. Fund your transfer by UPI transfer debit or credit card.

How Nri Can Exchange Rs 500 1000 Notes Outside India Old Rs Deposit Bank Of India

This is just an informational form with no taxes payable.

. Through a foreign currency demand draft. There is no limit in India or US. This can be done by declaring the source of income in the USA by consulting their Certified Public Accountant or.

Find out the TCS liable for your remittance transaction. Is money sent from India to USA taxable. As you daughter is US citizen there is no gift tax to her.

This is just an informational form with no taxes payable. Start your transfer by entering the United States as the destination along with the intended amount to send. But if it exceeds US 100000 for any current year you must report it to the IRS by filing Form 3520.

There are no taxes on money transferred from India to the US in India. Follow these tips to learn how to send money from India to the USA via a bank deposit. Assuming you are still Indian citizen when to gift the funds.

ICICI Bank 100000 INR 130378 USD ICICI bank is one of Indias leading banks which offers international money transfer solutions to and from India. How to transfer money from India to USA. Go to the Western Union website and register or log in to your profile.

Using an online international transfer provider. Your money is on its way. Whether or not this is necessary depends largely on the value of the transfer².

Transfer money from India to USA. Discuss with your tax advisor or consult a CPA or tax attorney for any tax related. WorldRemit XE Money Transfer TransferWise TransferGo CurrencyFair Ria Money Transfer Azimo Remitly Placid Express Travelex Skrill MoneyGram Western Union OFX Xendpay PostOffice InstaReM Venstar Exchange Remit Money QuickRemit OrbitRemit Remit2India Money2anywhere Xoom Money Transfer Pangea Money Transfer World First YES Remit Wells Fargo ICICI Bank.

But if it surpasses US 100000 for any current year you must report it to the IRS by filing Form 3520. Sending a wire transfer from your Indian bank. However if the money is in form of gift gift taxes in the US may be applicable.

Wire Transfer Through Banks Axis Bank SBI etc Wire Transfer through Money Changers UAE Exchange Thomas Cook etc There is a third option which we are not considering and that is Online Payment Services like PayPal Pioneer etc. NRIs in the USA must consult their CPA Certified Public Accountant to avoid any tax implications there. Tax collected at source TCS will be charged on money transfers abroad from India.

Set up your transfer using your beneficiarys bank details in the US. If youre in the US and want to send money to family members in India as a gift per the IRS the amount is excluded from taxes under the Gift Tax for gifts up to 15000 USD per year. However if the money is in form of gift gift taxes in the US may be applicable.

No the money transferred to US from India is not chargeable. The payment route used as well as costs cut off times and the processing times vary depending on where your money is headed. Click Send and voilà.

Above 15000 USD as gifts will trigger a tax event in most cases⁴. How To Send Money to the USA From India Online. Which documents will you need to send money from India to the USA.

But if it exceeds US 100000 for any current year you must report it to the IRS by filing Form 3520. You are not required to pay taxes on this amount. No the money transferred to US from India is not taxable.

Gifts from a business or a partnership that exceed 15797 also require that you file form 3520. When you sell a property in India youll need to understand the relevant taxes in both India and in the US if you intend to repatriate the funds. When transferring money from India to USA there are two legal ways to do it.

What are the routes to take money from India to US Will the money will go directly from my Bank Actto my. Avoid Double Taxes on money transferred from India to the US. If the gift exceeds 100000 you will need to fill out an IRS Form 3520.

In case someone sends you money from India to the US as a gift or inheritance you might need to report it to the IRS as a foreign gift on Form 3520 this is done with your US tax return. From Indian tax point of you there is no tax to you. Submission of the documents that are required to repatriate to the bank.

Therefore most NRIs prefer to keep an NRE Account. Taxes on investments in financial instruments. The deposits in this type of account are repatriable without any upper limit because there are no tax liabilities.

Ad Receive Payments from Clients and Companies Worldwide to One Payoneer Account. However In order to avoid tax implications in the USA you need to declare the source of income in the US. The United States Government does not levy taxes for transferring money from India to the USA but an NRI should avoid double taxes on the money transacted.

Choose Bank account as the collection method plus your method of payment. However if you fail to file this information you could incur a fine of up to 10000. In cases where you receive money from people you are not related with or are close to will be taxable if the amount exceeds 50000 in a year as it will be considered as your income.

However if the money is in structure of gift gift taxes in the US may be valid. Tax for sending money from UK to India. This is just an informational form with no taxes billed.

Transfer money from India to the USA the hassle-free way. No the money transferred to US from India is not taxable. Ad Receive Payments from Clients and Companies Worldwide to One Payoneer Account.

As the US and India have a double taxation agreement in place you should not need to pay the same taxes on the sale in both countries. Which is the best way to transfer a money to. Open an account online.

So you can effectively gift the entire amount without any taxes. Tax for sending money from USA to India. In order to repatriate funds from India to the US you will need to submit certain documents to the bank including a copy of your passport PAN card and Indian residential address proof.

Also there is no limit of the amount of money when you pay the taxes that are required that can be transferred from USA to India. Compare money transfer services on Monitos real-time comparison engine. 4 steps for Bringing money from India to USA from an NRE Account.

How To Send Money From Usa Or Canda To India Instantly Online In 1 Hour Send Money Forex Take Money

Send Money From Usa To Mexico With Remitly Send Money Money Transfer Money Online

Transfer Money To Usa Send Money From India To Usa Bookmyforex

Is India Less Corrupt Or Has The Nature Of Corruption Changed Deccan Herald

Before You Plan To Take Away Inheritance Money From India Inheritance Money Inheritance Tax Inheritance

1.jpeg)

If Someone Sends Money From India To Usa Is It Taxable

Transfer Money To Usa Send Money From India To Usa Bookmyforex

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Decoded 5 Tax On Foreign Fund Transfers That May Go Up To 10 For Some Business Standard News

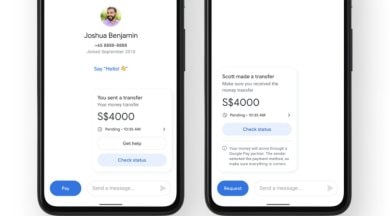

Google Pay Will Now Let Users In Us Send Money To Those In India Singapore Technology News The Indian Express

Income Tax Refunds Worth Rs 5 204 Cr Disbursed To 8 Lakh Msmes In Last 10 Days Cbdt Tax Refund Income Tax Income Tax Return

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

What Is The Best Way To Send Money To India For Nris Extravelmoney

How To Use Transferwise Money Transfer Money Online Send Money

Send Money From India To Overseas Businesses Western Union

How To Make Outward Remittance From Your Nro Savings Account The Financial Express

Here S How Much Money You Can Send Abroad From India Goodreturns

Outward Remittance For Nri Sbnri Bank Answers Sbnri

Cash Transactions Continue To Grow In India Here S Why The Financial Express